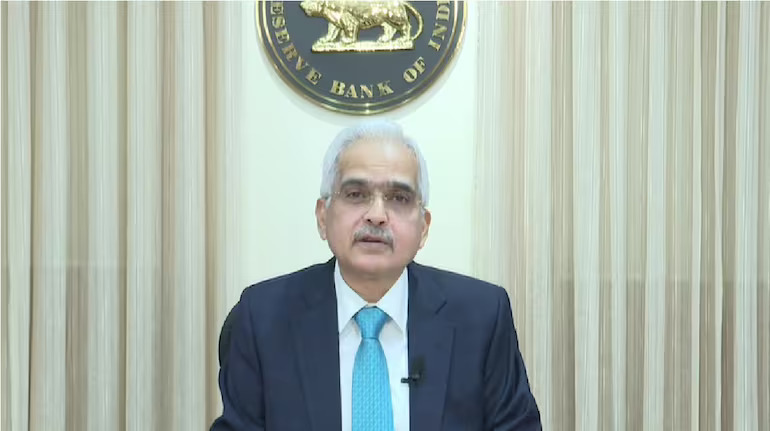

Reserve Bank of India Governor Shaktikanta Das announced on October 9 that the monetary policy committee has decided to maintain key policy rates for the tenth consecutive meeting amid ongoing inflationary pressures. He also stated that the policy stance has shifted from ‘accommodation’ to ‘neutral,’ potentially paving the way for future rate cuts.

Das’s speech followed expectations for a status quo on interest rates due to inflationary concerns and the potential escalation of the Middle East crisis, which could lead to a rise in commodity prices.

The central bank has maintained the repo rate, or short-term lending rate, at 6.5 percent since February 2023, with experts suggesting that any easing may only be feasible in December.

The government has instructed the central bank to maintain the Consumer Price Index (CPI) based retail inflation at 4 percent, allowing for a margin of 2 percent on either side.

In an off-cycle meeting in May 2022, the Monetary Policy Committee (MPC) raised the policy rate by 40 basis points, followed by subsequent rate hikes of varying sizes in the meetings leading up to February 2023. Overall, the repo rate was increased by a cumulative total of 250 basis points between May 2022 and February 2023.

Highlights from Shaktikanta Das’ speech:

*MPC considered it appropriate to change stance to neutral and remain unambiguously focused on bringing inflation to target durably

* Food inflation pressures could see some easing later in FY25

*The RBI kept its FY25 real GDP growth at 7.2 percent YoY and CPI inflation at 4.5 percent YoY

*Developments since August indicate progress in durable inflation targets

*Optimism on inflation is subject to shocks on weather conditions

*Inflation horse has been brought to the stable within the tolerance band. Have to be careful about opening the gate.

*Transmission to the credit market has been satisfactory.

*Per transaction limit in UPI 123Pay to be increased from Rs 5,000 to Rs 10,000. UPI Lite wallet limit increased from Rs 2,000 to Rs 5,000.

*RBI is closely monitoring incoming data on credit cards, MFI loans and unsecured loans.

*Banks and NBFCs need to give continued attention to inoperative accounts, mule accounts, cybersecurity landscape and a few other factors.

*NBFCs have registered an impressive growth in the last few years. Some NBFCs are aggressively growing without building strong underwriting practices.

*There are certain NBFCs where retail targets are driving growth rather than the actual demand.

*Self correction by NBFCs would be the desired option, though the RBI is keeping a close watch and won’t hesitate to take action if required.

*FPI flows have seen a turnaround from outflows of $4.2 billion to inflows of $19.2 billion between June-October this year

*FDI flows remain strong. India’s forex reserves have crossed milestone of over $700 billion

*RBI will continue to be nimble and flexible in liquidity management operations

*Retail inflation in September likely to see big jump due to unfavourable base, pick up in food price momentum

👉 Click here to read the latest Gujarat news on TheLiveAhmedabad.com