The Reserve Bank of India on Wednesday (April 9, 2025) approved the National Payments Corporation of India (NPCI)’s proposal to increase transaction limits for person-to-merchant (P2M) payments made through the Unified Payments Interface (UPI), citing evolving user needs.

NPCI, which oversees retail payment systems in the country, operates UPI — a real-time digital platform that facilitates seamless money transfers between bank accounts using mobile applications.

At present, the transaction limit for UPI payments — including both Person-to-Person (P2P) and Person-to-Merchant (P2M) — is capped at ₹1 lakh. However, certain P2M categories have been granted higher limits, with some set at ₹2 lakh and others up to ₹5 lakh, depending on the use case.

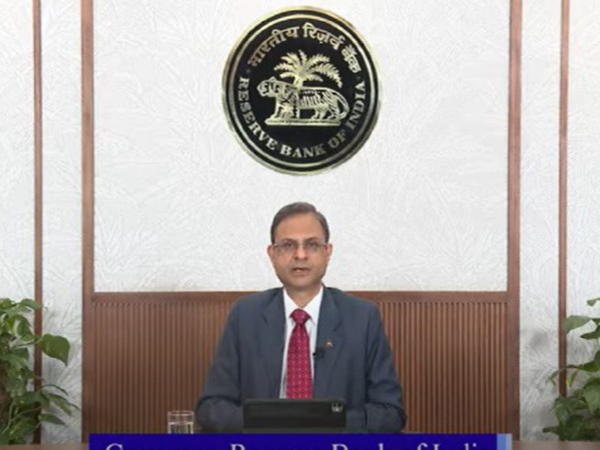

“To enable the ecosystem to respond efficiently to new use cases, it is proposed that NPCI, in consultation with banks and other stakeholders of the UPI ecosystem, may announce and revise such limits based on evolving user needs,” RBI Governor Sanjay Malhotra said. Appropriate safeguards will be put in place to mitigate risks associated with higher limits, he added.

Banks shall continue to have the discretion to decide their own internal limits within the limits announced by NPCI, the governor added.

P2P transactions on UPI, however, will continue to be capped at ₹1 lakh, as hitherto.

Governor Malhotra has announced that the Reserve Bank of India (RBI) plans to review existing guidelines for lending against gold jewellery. These loans, backed by gold ornaments, are provided by regulated entities (REs) for both personal consumption and income-generating activities. Over the years, the RBI has issued various prudential and conduct-related regulations for such loans, which currently differ across categories of lenders.

“With a view to harmonising such regulations across REs while keeping in view their risk-taking capabilities, and also to address a few concerns that have been observed, it has been decided to issue comprehensive regulations, on prudential norms and conduct related aspects, for such loans,” the governor said.

The Reserve Bank will soon issue draft guidelines on lending against gold jewellery for public feedback. In another move aimed at encouraging innovation, the RBI has proposed to make the Regulatory Sandbox (RS) framework ‘theme neutral’ and available ‘on tap’. This shift is intended to support continuous innovation and adapt to the fast-changing fintech and regulatory environment.

The RBI has been operating the Regulatory Sandbox (RS) since 2019, completing four thematic cohorts. In 2021, it introduced an ‘on tap’ facility for closed themes. A fifth ‘theme-neutral’ cohort, open until May 2025, allows testing of any eligible fintech solution under RBI’s regulatory scope.

“Based on the experience gained and feedback received from stakeholders, it is now proposed to make the regulatory sandbox ‘theme neutral’ and ‘on tap’,” Mr. Malhotra said.

The RBI will soon release a draft framework to allow securitisation of stressed assets via a market-based mechanism, beyond the current ARC route under the SARFAESI Act. It also plans to widen the scope of co-lending and introduce a unified regulatory framework for all co-lending arrangements among regulated entities (REs).

The extant guidelines on co-lending are applicable only to arrangements between banks and NBFCs for priority sector loans.

“In light of the evolution of such lending practices, and the potential of such lending arrangements in catering to the credit needs of a wider segment in a sustainable manner, it has been decided to expand the scope for co-lending and issue a generic regulatory framework for all forms of co-lending arrangements among REs,” he said.

RBI to issue draft guidelines for unified co-lending arrangements framework.

👉 Click here to read the latest Gujarat news on TheLiveAhmedabad.com