Aam Admi Party has raised serious questions on the calculation of data of property tax which was done by a private firm Cyber Tech & Software Limited.

The Aam Aadmi Party held a press conference in this regard where they raised several questions on the data which was collected by this firm.

Nagpur Municipal Corporation has announced under “Abhay Yojna 2020-2021”- “Tax collection of property and the 80% penalty will be waived on full property tax payment deposited within stipulated date and time”.

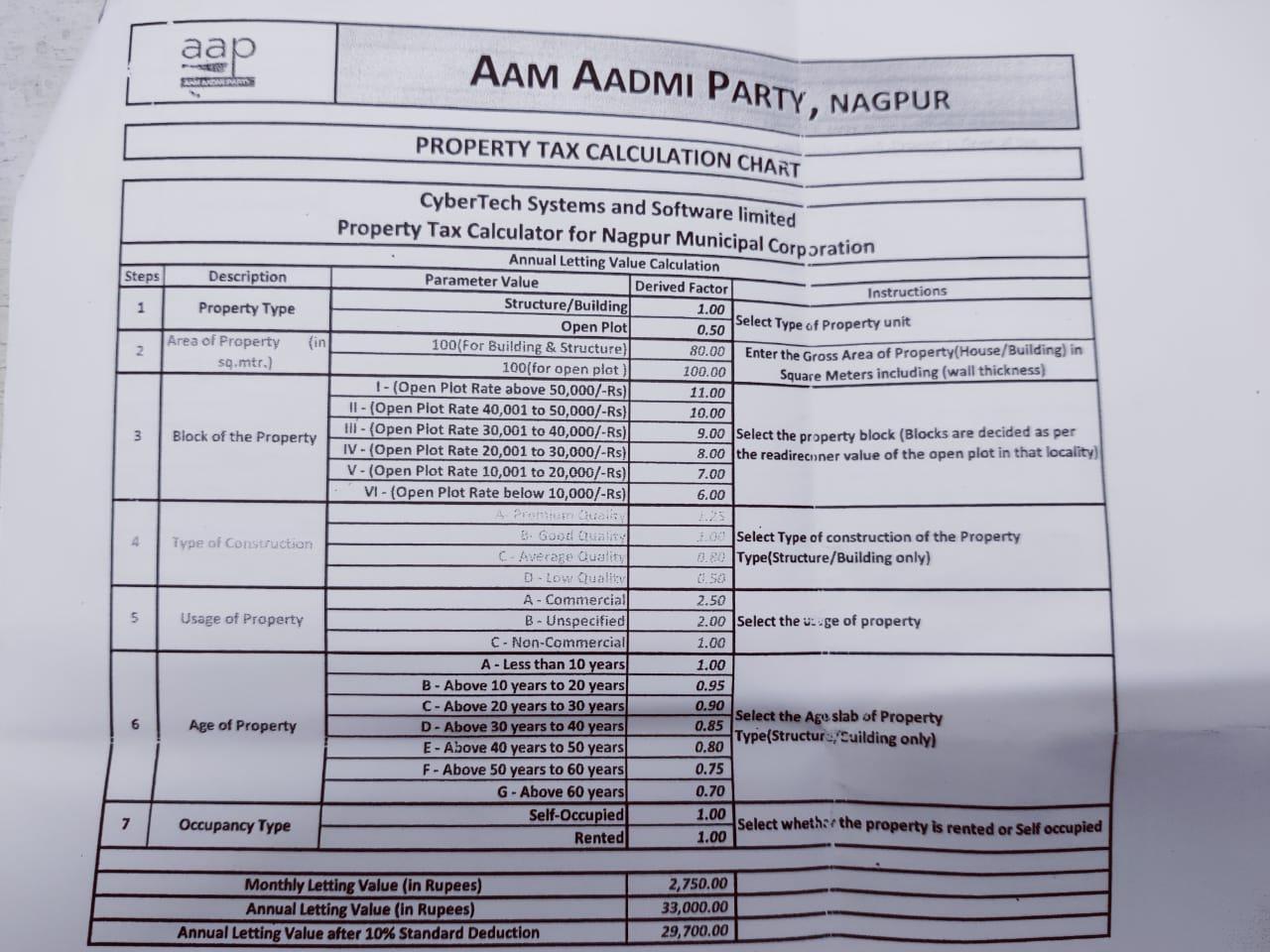

This property tax is being calculated based on software-based on certain parameters. The software has been developed a private firm “Cyber tech and Software limited” under the name of “Property Tax Calculator for Nagpur Municipal Corporation” which calculates the Annual letting Value (ALV) of the property, it has 7 parameters

- Property Type: Whether it is Structure/ Building/open plot.

- Area of Property in Sq. Mtrs; Gross area of the building including walls.

- Block of the Property: This has 6 categories with 6 based on Ready Reckoner value of open plot in that locality (It ranges from below Rs. 10000/-, Rs.10000 to 50000/-,Rs. 50000 above)

- Type of Construction: It has 4 categories –Premium/Good/Average /low

- Usage of Property: It has three categories –Commercial /Non-Commercial/ Unspecified

- Age of Property: It has 7 slabs ranging from 10 years to 60 years,

- Occupancy Type; Self/Rented.

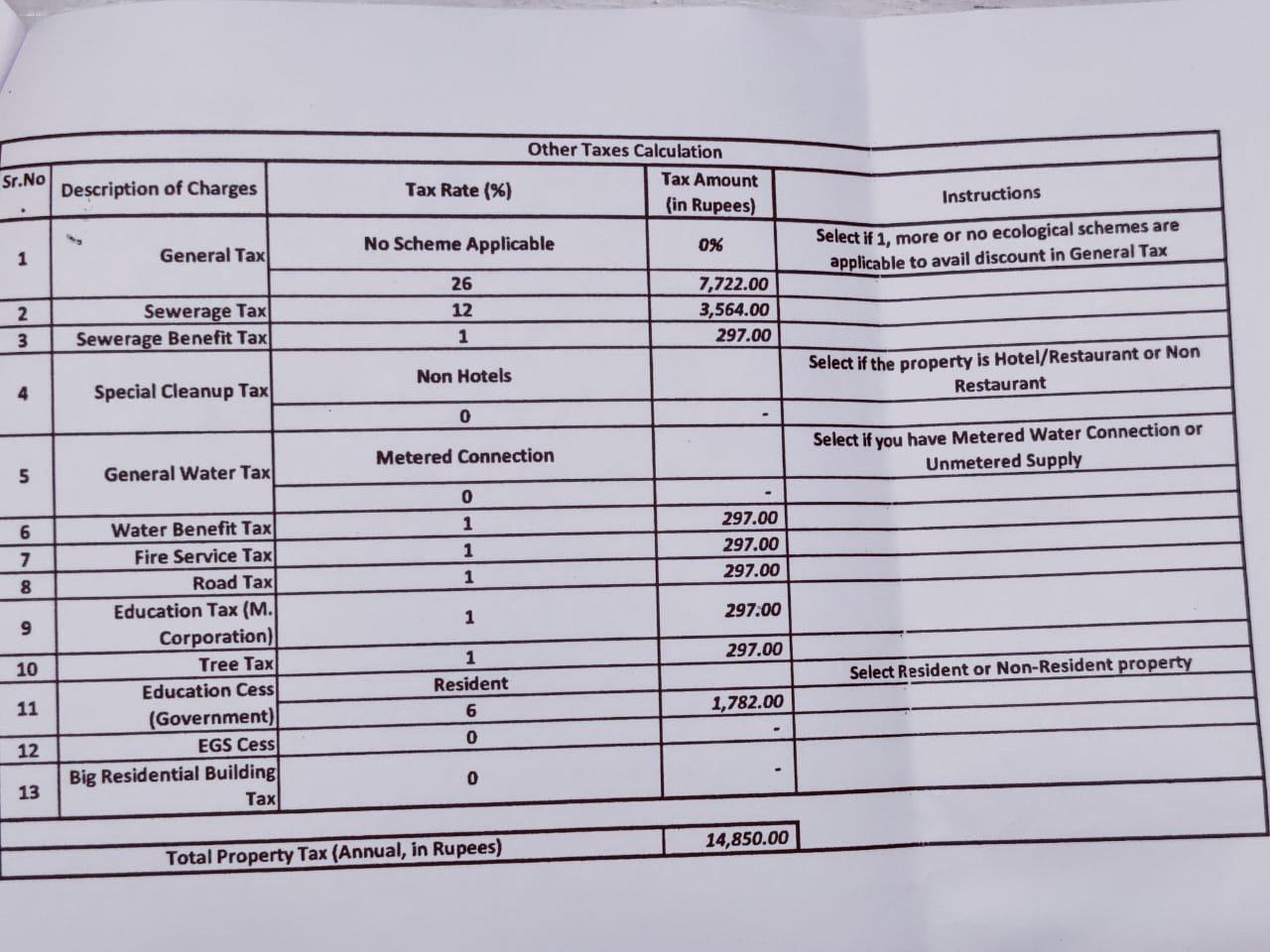

Based on these 7 Parameters “Derived Factor” has been allocated to each parameter respective to its sub parameters or slab Finally it calculates the monthly letting value and then annual letting value & after 10% standard deduction it calculates Net Annual letting value based on this net ALV, Property tax is calculated.

We wish to submit our Deputation on the above subject Nagpur citizen have received High Tax Demand Notice. The survey was done by a private “Cybertech and Software limited” as there are too many complaints regarding this tax, the tax calculated based on wrong parameters as the input to the software with these Faulty Data parameters, the citizens of Nagpur have got High Property Tax demand notice of House Tax, as a result, penalty thus calculated on the amount of high tax is also on much higher side, hence the penalty levied and 80% discount on it is not justifiable.

We demand that proper verification of these parameters by NMC department should be done again, not by any private agencies and the House Tax should be calculated based on correct parameters and a fresh demand note should be issued to the taxpayer.

We demand to setup enquiry on private agency “Cybertech and Software Private limited” who has done faulty survey & hence wrong inputs were given to the software, which resulted in high house tax calculations. The penalty should be levied on “Cybertech and Software Private limited” as it is their fault and not the citizens.

We demand that instructions should be given for correction of this Parameter for Nagpur Citizens, otherwise we will go to the public and protest against this unjustified tax collection based on wrong methodology.

1) Complete Reassessment of the PARAMETERS by NMC & not through Private Agency.

2) SET UP ENQUIRY on Private agency to whom NMC had given contract “Cybertech and Software Private limited” should be constituted for faulty survey and Wrong inputs in the Software.

3) 100% Fine should be waived Off, Fine should be recovered from “Cybertech and Software Private limited for their fault.

4) Fine Recovered till date should be readjusted after revision of the House Tax

5) Four months time should be after this reassessment by NMC for the payment of house tax.

👉 Click here to read the latest Gujarat news on TheLiveAhmedabad.com