Did you ever think of becoming a social media influencer because you are weirdly attracted to the freebies they get to use? Well, the social media influencers will soon have to pay TDS for the freebies they receive.

As per reports, the government will levy a 10 per cent TDS on freebies they receive from businesses for promotion. Along with the influencers, doctors will also have to pay tax on the freebies they receive from pharmaceutical companies and others.

As per reports, social media influencers will have to pay a TDS of 10 per cent if the product given to them for sales promotion is retained by the influencers. If they return the device to the company after the job is done, TDS will not be applied to the product, Central Board of Direct Taxes (CBDT) stated in the guidelines.

“Whether this (the product given for sales promotion activity in social media) is beneficial or perquisite will depend upon the facts of the case. In case of benefit or perquisite being a product like car, mobile, outfit, cosmetics etc and if the product is returned to the manufacturing company after using for the purpose of rendering service, then it will not be treated as a benefit or perquisite for the purposes of section 194R of the Act (the TDS provision),” CBDT said.

However, if you are an influencer and receive free samples, you will not be charged any money. For instance, if you receive a beauty product as a sample, you will not be liable to pay charges. TDS would apply in products including cars, television, mobile phones, free tickets, foreign trips and other goodies given to promote a business.

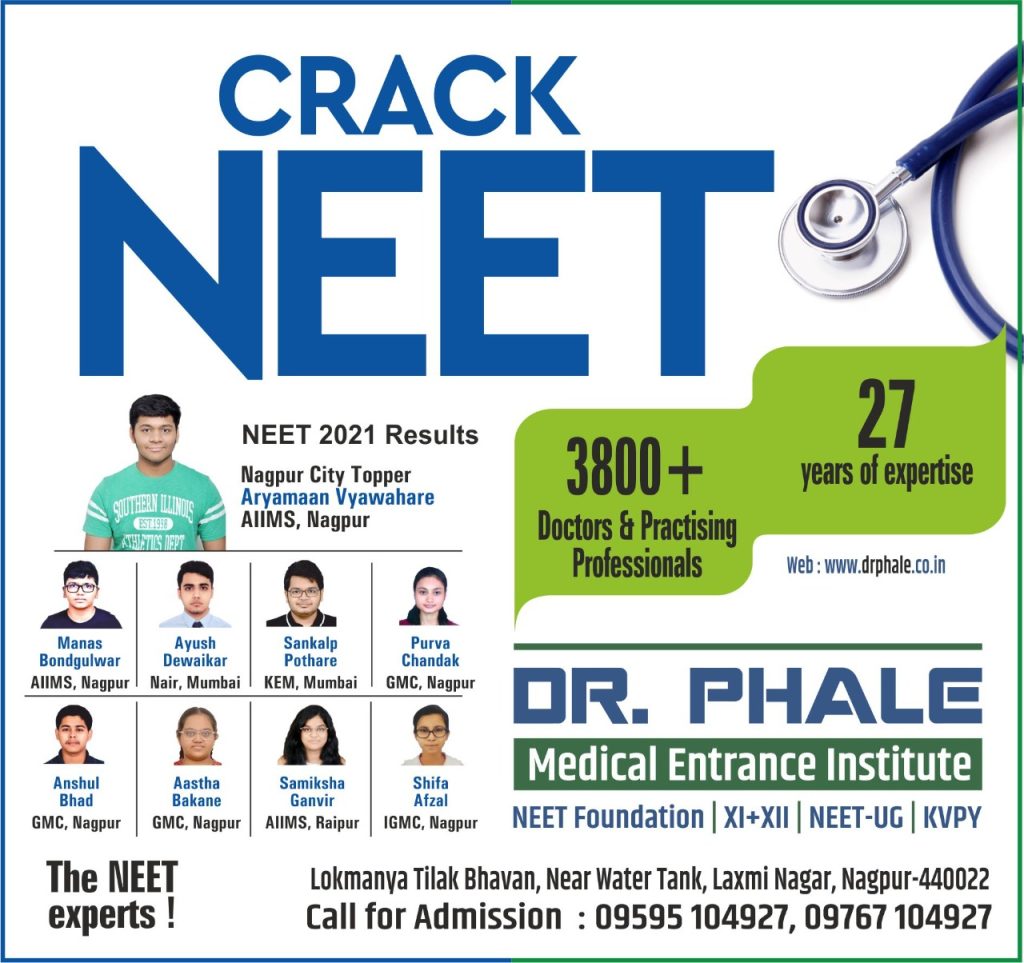

If you are a doctor and you are employed with a hospital, you will be liable to pay taxes on the free medicines that you get. The hospital will treat it as a benefit and deduct income tax.

“In such a case, it would be first taxable in the hands of the hospital and then allowed as deduction as salary expenditure. Thus, ultimately, the amount would get taxed in the hands of the employee and not in the hands of the hospital. Hospitals can get credit of tax deducted under section 194R of the Act by furnishing its tax return,” CBDT noted.